We create clarity.

We appraise both single properties and entire real estate portfolios.

Independent property valuation

Independent property valuation

Because our valuation specialists are familiar with all kinds of property use, we are able to provide you with professional assessments of both single properties and real estate portfolios – and give you valuable information to assess your options and make key decisions. We stay close to the market and our appraisals reflect that, thanks to our daily activity in the space and transaction markets, and constant exchange with our local and global experts. As a result, we can always guarantee an up-to-date and independent valuation of any type of real estate.

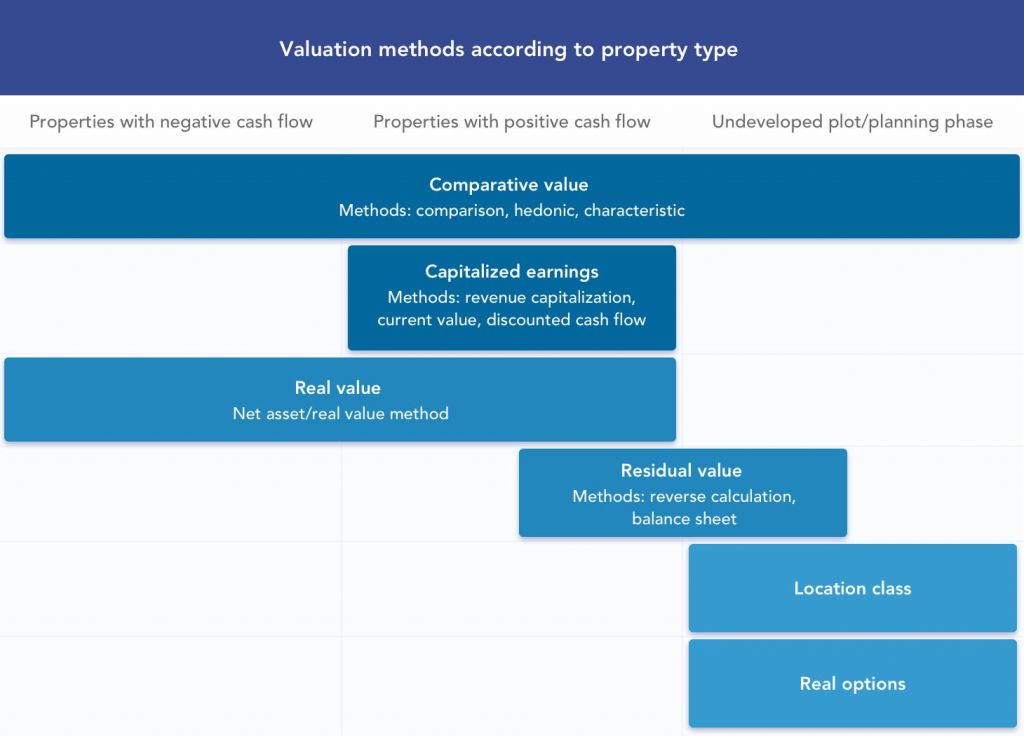

Summary of valuation methods

Services

The first step of the valuation process is always a thorough analysis of the starting point. We consolidate our findings and results in a clearly formatted, transparent and easy-to-follow report.

- Valuation services: Single property

We prepare an independent valuation report based on the following steps:

- Property visit

- Analysis of location (macro and micro) and relevant real estate market

- Analysis of legal status e.g. land registry, building and occupancy laws

- Assessment of market rent price, accounting for quality of location and property as well as type of use

- Rough analysis of property condition to identify any maintenance issues or construction faults

- Analysis and assessment of operating, maintenance and repair costs

- Determination of the discount rate

- Photo documentation

- Evaluation report

Our property valuations, based on the principles of the Royal Institution of Chartered Surveyors (RICS), use the following methods:

- Discounted cash flow

- Earnings

- Comparison

- Hedonic valuation

- Valuation services: Portfolio

As an independent valuation expert, we provide fair-value assessments of large real estate portfolios. We also help many longstanding clients with their annual valuations.

We prepare an independent valuation report of the portfolio based on the following steps:

- Property visits

- Analysis of location (macro and micro) and relevant real estate market

- Analysis of legal status per property e.g. land registry, building and occupancy laws

- Assessment of market rent price, accounting for quality of location and property as well as type of use

- Rough analysis of property condition to identify any maintenance issues or construction faults

- Analysis and assessment of operating, maintenance and repair costs

- Determination of the discount rate

- Photo documentation

- Evaluation report

Our property portfolio valuations, based on the principles of the Royal Institution of Chartered Surveyors (RICS), use the following methods:

- Discounted cash flow

- Earnings

- Comparison

- Hedonic valuation

Would you like to speak with us?

Would you like to list your retail or office space?

If you need help finding the right tenants for property/space from your portfolio, SPGI is the ideal partner.